Whenever you have to borrow money from a bank, a lender, or any credit card union, you might be asked to sign a promissory note. However, even if you are not the borrower but a lender, you should still familiarize yourself with the promissory note form.

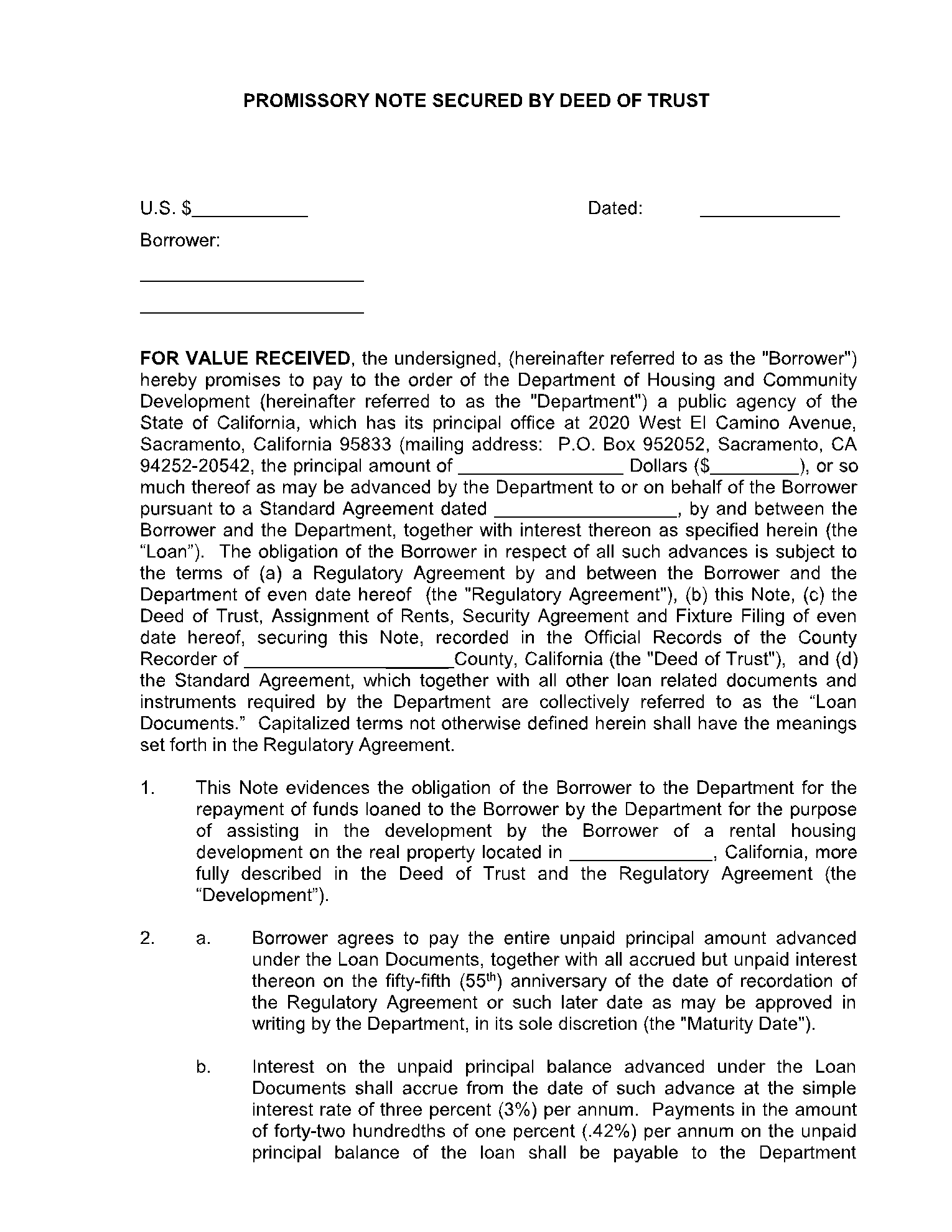

A promissory note contains a written legal agreement between a borrower and the lender about the loan and the associated loan terms within the agreement.

What Is a Promissory Note?

A promissory note, also known as 'Demand Note,' is a promise-to-pay financial note that details a written promise that is issued by a single party. The borrower party, through this note, formally claims that they will pay a certain amount of money. The money can be paid either at a specified date or on-demand. The borrower is held responsible through this note for paying back the money, inclusive of tax.

A sample promissory note consolidates a legal binding between the borrower and the issuer. Any simple promissory note also describes what will happen in case there is a failure in paying back the loan. The promissory notes are often issued at the time of taking out a loan in order to formalize the procedure instead of having a verbal agreement.

A free promissory note will include all the terms that are associated with the debt amount, such as the interest rate, principal amount, maturity date, etc. It is used by companies as well as individuals to get financing from sources that do not directly involve a bank. The source holds the note and issues the finances as described by the rules and regulations.

When Is a Promissory Note Needed?

A promissory note sample can be important for different reasons. When you do not want to give up on the equity, you should consider holding a basic promissory note. In addition to that, you could use it to hold yourself off from the expense of a full securities offering.

It could also be used as a way to portrait the debt as your business debt rather than having it on your personal account's credit. Another circumstance to use a legal promissory note is to formally define when the loaned money can be withdrawn by the founders.

Typically, you will come across these situations if your dealings include one or more of the following loans:

- Personal Loans: Personal loans that include loans between friends or families or bills etc.

- Student Loans: These loans are issued by an institution or another party for education-related expenses, including tuition fees.

- Business Loans: This includes business-related loans. An example could be capital that is taken for a business startup by an individual or a team of individuals.

- Real Estate Loans: Real estate loans include property-related loans, e.g., down payment for a property.

What Are the Key Components of a Promissory Note?

A promissory note may vary based on the loan terms used for the agreement as well as on the state’s law in which the promissory notes are issued. However, a simple promissory note includes the following key components:

- Borrower and Lender Information: A free promissory note template clearly outlines the personal information about the borrower party and the lender party, such as their names and addresses. However, some promissory notes may also include social security numbers or employee IDs.

- Loan Information: A brief information that clearly defines the loan terms and payments needs to be mentioned in the promissory note example. This includes the date of the loan, the amount of the loan, the issued date for the amount to be paid back, the interest rate, and the payment schedule.

- Security Agreement: Although not always, but a basic promissory note may include a security agreement. A secured legal promissory note has collateral tied to it. In the case of real estate dealings, the makers often get the note secured by mortgages that allow lenders to foreclose by default.

- Warnings: A promissory note form may include warnings for consumers to hold them off from committing fraudulent activities or crimes using the note.

Conclusion

A promissory note is a formally defined note which illustrates that the borrower has to repay a certain amount of money by the deadline. Promissory note form is often used by students, real-estate dealers, and businessmen. However, as stated in the article, anyone can issue them to another party for successfully carrying out their personal transactions.