Secured Promissory Note Templates help you generate a legally binding agreement that helps the promisee to get full payment of the money by the promiser. Anyone can download this template to generate this note. Additionally, it works in all the States of the United States.

The use of a secured Promissory note depends on the understanding of the lender and borrower. Therefore, the Collateral works as a guarantee to the lender for the recovery of their money.

What is a Secured Promissory Note?

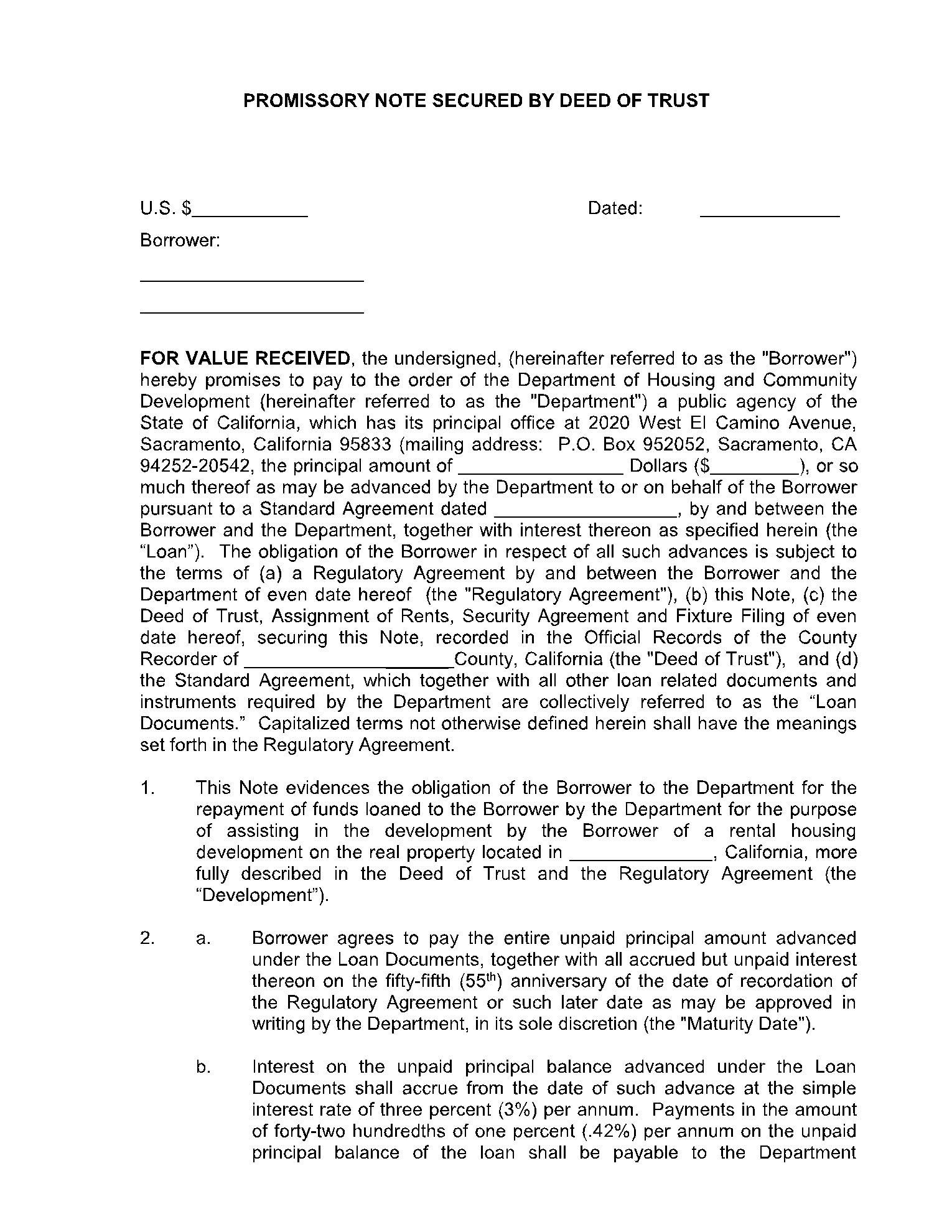

A Secured Promissory Note is an agreement between the lender and the borrower. It is generated when a person takes a loan from someone that includes some type of collateral. It means if the borrower fails to repay the loan, the lender has the right to sell over the property to recover the amount.

It is called a Secured Promissory note because it provides loan security to the lender. The amount is recoverable even if the borrower fails to repay the loan. On the other hand, it has different benefits to the borrower as the interest rate on such loans is way lower than other types of loans.

What Information Should Be Included in a Secured Promissory Note?

There are no special requirements for a Secured Promissory Note. however, it must fulfill the basic requirements that make it a legally binding agreement. Here are some details that must be mentioned on a Promissory Note Template.

Information Of Both Parties

The main part of this agreement includes the complete details of the lender and the borrower. It must contain the name and contact details of each party. Additionally, it should mention the complete address along with the ZIP Code.

Amount and Time Period

The next section includes the total amount borrowed by the borrower. It includes the principal amount along with the applicable interest on this amount. Additionally, you must mention the time period in which the amount is to be repaid to the lender.

Collateral Details

A Secured Promissory Note requires some kind of Collateral. Therefore, you must mention the collateral details and the terms related to it. The terms usually cover the process if the person fails to repay the loan.

Acknowledgment

The last section includes the acknowledgment by both parties. The lender will acknowledge that they have received the collateral and lent the discussed amount. On the other hand, the borrower will acknowledge the payment terms and the process of dealing collateral in case he fails to provide the amount.

How to Write a Secured Promissory Note?

Follow these steps to write a Secured Promissory Note.

Step1: Mention the Details of Each Party

Choose a Secured Promissory Note template and mention the details of the lender and borrower on the template. The details include the name, address, and lending amount discussed by both parties.

Step2: Discuss Payment Terms

Mention the payment terms that cover how and when the loan will be paid. It also covers the consequences of payment failure and the responsibilities of each party in such circumstances.

Step3: Mention the Collateral

The final one is to mention the collateral that is being secured for the loan. It must be mentioned how the failure of payment will affect the collateral and the rights of the lender.

Conclusion

A Secured Promissory Note is useful when some kind of collateral is involved to secure the loan. It has benefits for both parties as it protects them from unreasonable charges.